Ukraine is the world’s largest producer of sunflower oil, accounting for more than 21% of the total volume. Globally, it accounts for 10% of total edible fat consumption. In addition, Ukraine is the main Spanish supplier of this vegetable fat.

The Crimean peninsula in Ukraine has an ancient olive-growing tradition. Large, centuries-old olive trees can still be found in many parts of this region. At the beginning of the 19th century, olive growing experienced its golden age. After that time it gradually gave way to cereals, Ukraine’s main crop. It was reduced in such a way that it even disappeared as a cultivable crop, being reduced to ornamental trees or isolated centenary olive trees, the largest plantation amounting to only 1.5 hectares in the area of Simeiz.

The climatic conditions are not the most favorable for olive groves; most of the country has a continental climate. However, on the southern coast of the Crimea, with a more Mediterranean climate, olive growing has been revived, with several hectares of olive groves and six olive mills.

Ukraine is a small olive oil producing country. It has only 90 hectares under olive cultivation, spread over 27 plots, with an average size of 3.33 hectares. This makes it the 61st largest producer out of the 66 countries that currently cultivate olive trees. It represents 0.0007% of the world’s olive grove area, i.e. it is an almost testimonial crop.

The agricultural area in Ukraine occupies 42 million hectares (71% of Ukraine’s land area). It is the country with the largest arable area in the world, preceded by Denmark. The availability of land is one of the key factors in the development of the country’s agricultural sector.

On the other hand, some progress has been made, such as regarding the land ownership regime. In 2021, the moratorium prohibiting the sale of land in the country was lifted, thus allowing nationals to acquire land in property. But it will not be until 2024 that the acquisition of land by foreigners will be voted on in a referendum. This measure promotes the realization of large investments by both nationals and foreigners, favoring the economic development of the primary sector.

Olive plantations in Ukraine are efficient, modern, intensive olive groves under a rainfed irrigation system. The main varieties grown are: Picual, Arbequina, Koroneiki and Arbosana. Almost all of the olives are destined for olive oil production, and table olive production is almost non-existent.

The average harvest of the last three seasons was 70 tons, from which, with a 14% yield, 9.8 tons of olive oil were obtained. The productivity of the Ukrainian olive grove is low, 0.803 tons of olives per hectare and 0.112 tons of olive oil.

Seventy-five percent of the oil obtained is virgin and extra virgin olive oil and the remaining 25% is lampante virgin olive oil. It is noteworthy that although it is not a major producer country, the quality of olive oil production is of prime importance.

Ukraine has a clear profile as an importer of olive oils, since its production cannot supply domestic demand. It mainly imports olive oils from Italy and Spain.

The turnover of the olive oil sector is 0.033 million euros. The Ukrainian olive oil industry is very small; there are only 6 very small olive mills in the country. In terms of employment, 11,703 annual workdays are generated, or 51 permanent jobs.

Although the cultivation tradition is ancestral, in terms of demand, olive oil consumption is not particularly high.

The main competitor of Spanish olive oil is sunflower oil, of which Ukraine is the leading producer. This is due to the long tradition of its consumption, its lower price than olive oil and the market penetration of national brands.

However, the Ukrainian consumer perceives olive oil as a product of quality and healthy properties, unlike other oils (such as palm or rapeseed oil), which are associated with low quality. Ukraine has a growing culture of olive oil consumption, and in recent years the popularity of high oleic sunflower oil has increased. It is the most similar in its physicochemical composition to olive oil, but has a lower price than olive oil.

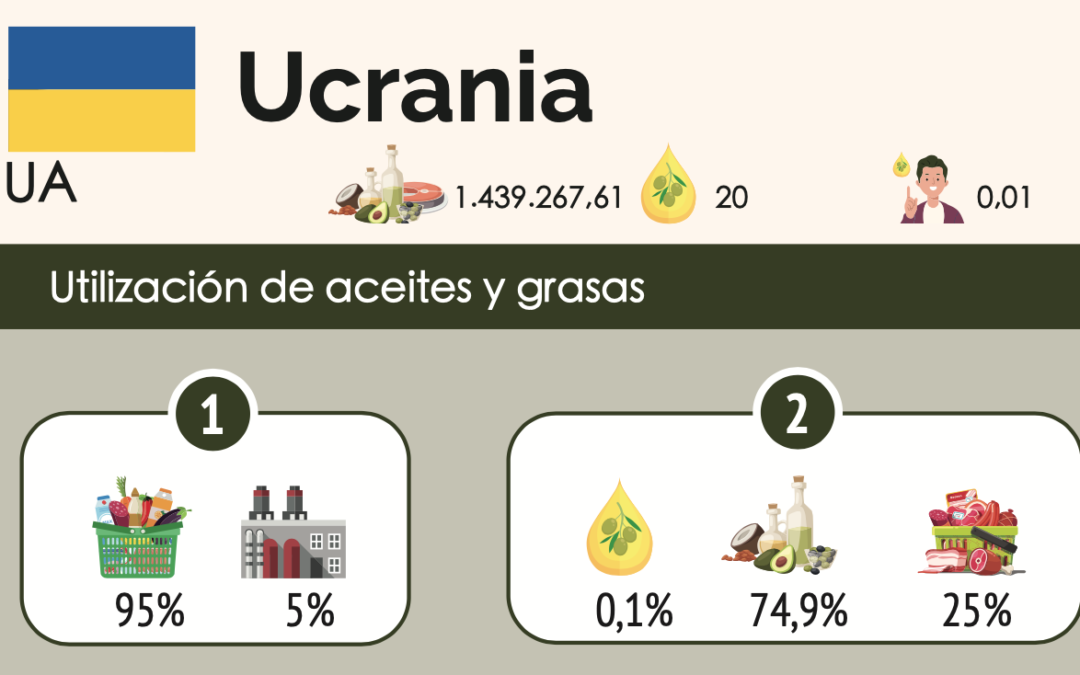

Of the total amount of vegetable and animal fats consumed in Ukraine, 1,439,267 t, only 0.1% is olive oil, 25% is animal fats, and 74.9% is consumed from other vegetable fats.

As mentioned in the previous paragraph, 1,440 tons of olive oils are consumed in Ukraine. Of which, 1,368 tons (95%) is intended for human consumption and the remaining 72 tons (5%) for industrial use. Consumption per person per year is 0.01 kg.

The profile of the Ukrainian consumer is mainly male (55.3%) in greater proportion than women (44.7%) over 34 years of age (94% of the olive oil consumed). Of medium-high purchasing power (48%) residing in the urban core of the large Ukrainian cities.

Regarding the family structure of the consumer, 48% is consumed by families with children, both young and middle-aged, 20% is consumed by families without children (7% young families without children and 13% middle-aged families without children), followed by single people or widows (17%) and single-parent families (15%).

If we measure consumption according to educational level, slightly more than 6 out of 10 liters of olive oil are consumed by people with medium-high education with secondary education (23%) and university education (40%).

The Ukrainian consumer gives priority to the quality of olive oil, with the majority consuming extra virgin olive oil (40%), followed by refined (35%) and virgin (20%). Olive pomace oil accounts for the remaining 5%.

In terms of packaging, 74% is purchased in PET format, followed by oil packaged in glass (28%), with the remaining 2% purchased in cans.

Its main use is for raw consumption, as a salad dressing and seasonally, since its consumption increases in summer. It is also used for cooking (24%) and to a lesser extent for grilling or frying (5% and 1% respectively).

Most of it is consumed at home, 88%. Consumers usually buy it in supermarkets (43%) and hypermarkets (25%), followed by direct purchase in oil mills, packing plants and other points of sale (21%). It is purchased via the Internet by 8% of consumers and the remaining 3% in traditional stores.

Of the 12% of olive oil consumed outside the home, it is mainly consumed in hotels (30%) and restaurants (30%), followed by collectivities such as schools, hospitals, etc. (20%) and the canning industry (20%). (20%) and the canning industry and food processing industry (10% respectively).

Currently, the war between Ukraine and Russia has blocked imports of olive oil from these countries, which imported one million tons last year. It is having a negative effect on olive oil consumption, with the fall in demand in Russia, since it is the largest non-producing consumer country.

On the other hand, the stoppage of sunflower oil exports from Ukraine has caused the price of sunflower oil to rise. This has a positive impact on olive oil, as olive oil is the main substitute for sunflower oil and demand is increasing.